Are You Prone to Making These Common Money Mistakes? Here’s How to Stop Today

Truth be told, we have all made a poor financial decision or two over the years. The silver lining is that these decisions offer an opportunity to learn, allowing us to manage our money much better in the future.

Despite making financial mistakes every now and then, the one thing we can all agree on is that most of them are preventable. We may have noticed this through our own experiences or through those of others, but we’re all in consensus, aren’t we?

Planning and Implementing

All you need is a little bit of planning

As is the case with everything else, all you need is a little bit of planning and the tenacity to implement everything your plan stipulates. This way, you are bound to be so good with money that you may amaze your former self.

Unfortunately, most Americans are knee-deep in debt, with medical debt being one of the reasons why most citizens go bankrupt. In addition to the ever-increasing cost of healthcare, people fall into this debt due to poor insurance and ignorance where payment options are concerned.

To avoid this, get yourself a job that comes with quality insurance as one of its perks. If this isn’t possible, plan for how you can independently have proper coverage, and also update yourself on payment options if you ever accumulate medical debt. Having said that, however, we must understand that due to the nature of some illnesses, you can run into debt despite having quality insurance.

All the same, don’t ever use your credit card to cover debt incurred due to medical services. Why so? Medical debt can be paid interest free and through reasonable installments, so why used a card that you’ll eventually have to pay for and with interest? That’s like unnecessarily increasing your expenses.

Zero Excuses

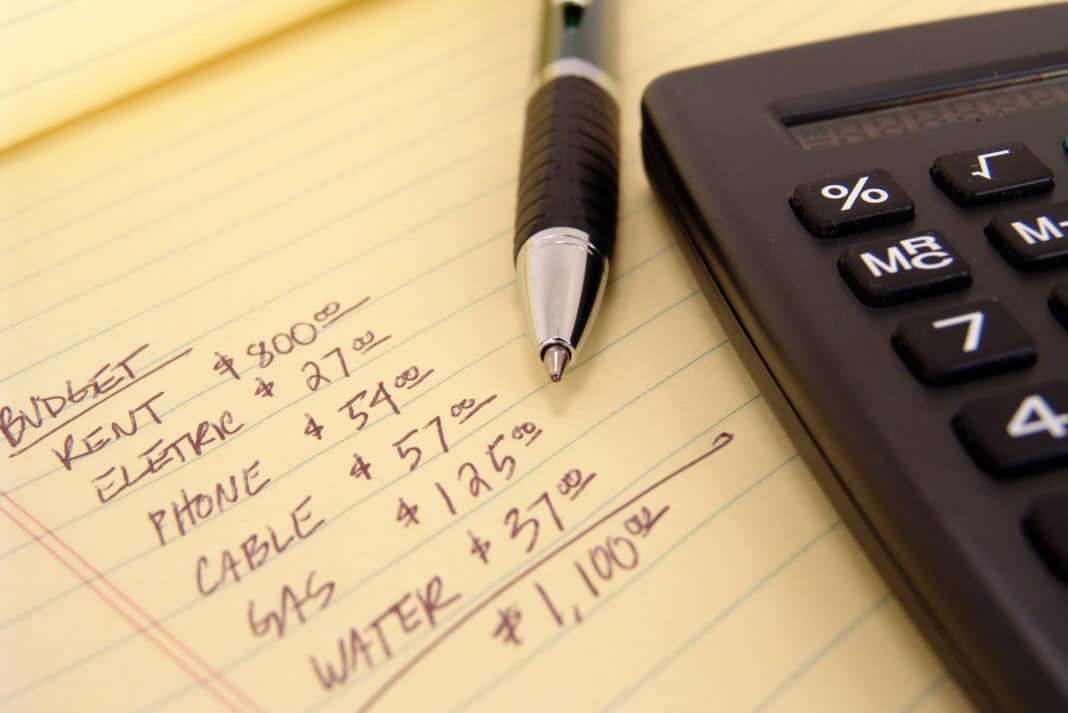

And while medical debt can catch you unawares, you have no excuse for being unprepared for your recurrent expenditure. The reason why you’re always short on cash is because you don’t have a budget, and if you have one, you hardly ever stick to it.

You have no excuse for being unprepared for your recurrent expenditure

According to experts all around the world, a budget is the epicenter of an individual’s concrete monetary plans. If you’re yet to have one, now is the perfect time to come up with one. Of course, it has to be realistic, factoring in both your income and monthly expenses.

If you have one that you don’t stick to, find out the reason behind those impulsive shopping sprees and other extravagant habits. Is there anything stressing you? Does being a spendthrift fill an emotional void? Take yourself through a rigorous soul-searching process, and only then can you determine how best to move forward.

While a budget could be short-term, planning ahead should take the long-term approach. This is in terms of saving for college, retirement, and that emergency fund you’ve always thought of. Life as we know it can be largely unpredictable and there’s nothing we can do about that. If for whatever reason you’re out of a job tomorrow, how will you survive the next few months?

Your emergency fund should support you for at least three months

That’s where the emergency fund comes in. Experts recommend that your emergency savings account should comfortably support you for three months if you suddenly lose your source of income. You know now what you have to do, don’t you?

More in Financial Adviser

-

How to Lock In a ‘Good’ APR on Your Personal Loans?

When it comes to borrowing, understanding the intricacies of the Annual Percentage Rate (APR) can feel like deciphering a secret code....

March 13, 2024 -

How to Find the Best Personal Loan With Easy Monthly Payments in 2024

A personal loan is an amount of money borrowed from a financial institution, which you pay back in regular monthly payments...

March 8, 2024 -

Why Italy Tops the List for Solo Adventurers

Forget the guidebooks and ditch the group tours. If your soul craves an adventure that’s uniquely yours, then pack your bags...

March 3, 2024 -

From Talking Cars to AI: The Latest Car Tech at CES

Imagine having a chatty companion on your next road trip. One that tells jokes, remembers your preferences, and even helps plan...

February 24, 2024 -

Know the Pros & Cons of Personal Loans Before Applying!

Are you eyeing a personal loan, perhaps to consolidate debt, finance a home renovation, or cover an unexpected expense? Before you...

February 17, 2024 -

What Are Some Major Benefits of a Business Bank Account & How to Open One?

A business bank account is not just a fancy accessory. It is a necessity. Imagine your business as a high-performance vehicle....

February 7, 2024 -

Navigating the Ties Between Love, Living Together, and Financial Security in Retirement

Picture this: you’re nearing retirement, a time for relaxation and enjoying the fruits of your life’s hard work. But here’s a...

January 29, 2024 -

Top 5 Superyachts of 2022

In a world where social distancing became the buzzword, the allure of superyachts took on an even more glittering appeal in...

January 23, 2024 -

Mark Cuban’s Proven Tips for Business Success

Dive into the dynamic world of entrepreneurship with the maverick mind of Mark Cuban, a serial entrepreneur whose $4.6 billion fortune...

January 20, 2024

You must be logged in to post a comment Login