Understanding the Impact of Fed Rate Hikes on the Economy

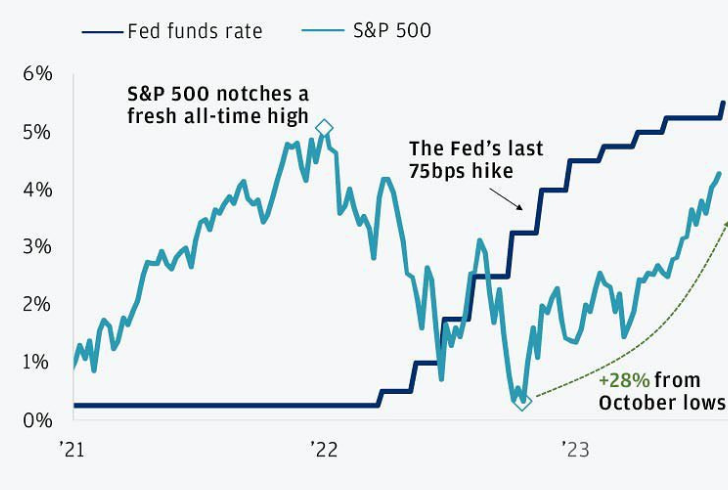

In the vast and ever-evolving landscape of the U.S. economy, the Federal Reserve plays a crucial role in steering the ship. Recently, they set the benchmark federal funds interest rate at 5.5%, prompting curious minds to wonder: why does it take so long for these rate hikes to influence our economic journey, and why might their impact linger for a decade or more?

Instagram | Federal Reserve set the benchmark federal funds interest rate at 5.5% in 2023.

The Ripple Effect: A Gradual Unfolding

Unlike an instant impact, the consequences of Fed rate hikes unfold gradually, akin to ripples spreading across a pond. These changes don’t hit all consumers simultaneously, with the initial impact often felt by those venturing into new financial territories, like first-time homebuyers. Imagine it as a story—each chapter building upon the last.

The Dance of Contracts: Slowing the Tempo

In the intricate dance of the economy, contracts in business play a significant role in slowing down the ripple effect of Federal Reserve decisions. These contractual arrangements act as buffers, influencing the pace at which changes permeate various sectors. It’s a nuanced rhythm that shapes the economic symphony.

A Savings Cushion: Weathering the Storm

Pexels | Consumers have found themselves with unexpected cushions of savings.

Surprisingly, consumers have found themselves with unexpected cushions of savings, thanks to altered pre-Covid spending habits. This newfound financial resilience provides insulation against the immediate need to borrow. Picture it as a shield—guarding against the full impact of interest rate hikes and altering the traditional timeline of economic cycles.

The Long-Lasting Echo: A Decade-Long Tale

Delving into the pages of a research paper from the Federal Reserve Bank of San Francisco reveals a fascinating narrative. A mere 1% interest rate increase can cast a shadow on the Gross Domestic Product (GDP) for an astounding 12 years after the initial hike.

This revelation poses questions about the dual nature of its impact—troublesome in the short term yet equally concerning for the long-term health of wages and productivity.

The Market’s Swift Choreography: A Dance of Variability

Instagram | Markets respond to Federal Reserve policies swiftly, sometimes even instantaneously.

While the economy may move at a deliberate pace, financial markets seem to have a dance of their own. Some economists argue that markets respond to Federal Reserve policies swiftly, sometimes even instantaneously.

Federal Reserve Governor Christopher Waller suggests that the tightening of policies occurs not at the moment of rate changes but with the mere announcement—an intriguing twist in the plot.

A Symphony of Economic Dynamics

Understanding the enigma of why Fed rate hikes take their time to impact the economy requires delving into the intricate symphony of economic dynamics.

Like a well-composed piece of music, each instrument (or economic factor) contributes to the overall harmony, creating a narrative that unfolds gradually yet resonates for a decade or more. As we navigate this economic journey, the melody of interest rates continues to play a crucial role, shaping the chapters of our economic story.

More in Bank Stories

-

How to Lock In a ‘Good’ APR on Your Personal Loans?

When it comes to borrowing, understanding the intricacies of the Annual Percentage Rate (APR) can feel like deciphering a secret code....

March 13, 2024 -

How to Find the Best Personal Loan With Easy Monthly Payments in 2024

A personal loan is an amount of money borrowed from a financial institution, which you pay back in regular monthly payments...

March 8, 2024 -

Why Italy Tops the List for Solo Adventurers

Forget the guidebooks and ditch the group tours. If your soul craves an adventure that’s uniquely yours, then pack your bags...

March 3, 2024 -

From Talking Cars to AI: The Latest Car Tech at CES

Imagine having a chatty companion on your next road trip. One that tells jokes, remembers your preferences, and even helps plan...

February 24, 2024 -

Know the Pros & Cons of Personal Loans Before Applying!

Are you eyeing a personal loan, perhaps to consolidate debt, finance a home renovation, or cover an unexpected expense? Before you...

February 17, 2024 -

What Are Some Major Benefits of a Business Bank Account & How to Open One?

A business bank account is not just a fancy accessory. It is a necessity. Imagine your business as a high-performance vehicle....

February 7, 2024 -

Navigating the Ties Between Love, Living Together, and Financial Security in Retirement

Picture this: you’re nearing retirement, a time for relaxation and enjoying the fruits of your life’s hard work. But here’s a...

January 29, 2024 -

Top 5 Superyachts of 2022

In a world where social distancing became the buzzword, the allure of superyachts took on an even more glittering appeal in...

January 23, 2024 -

Mark Cuban’s Proven Tips for Business Success

Dive into the dynamic world of entrepreneurship with the maverick mind of Mark Cuban, a serial entrepreneur whose $4.6 billion fortune...

January 20, 2024

You must be logged in to post a comment Login