Mistakes to Avoid When Trying to Save Money

Financial independence is the main goal why people try to save money. The objective of saving money may mean different things to various people but it is, in fact, gaining control over your life and your decisions.

When you begin saving money it is essential for you to have a plan and ensure you are prioritizing your goals and most importantly making sure you are adequately prepared to meet your goals. In order to help you begin your savings plan on the right track, we have compiled a list of mistakes to avoid when trying to save money. People who are beginning to save money often make mistakes which prove dear to them later in life. Following the tips we have provided you can avoid these mistakes and achieve your objectives faster.

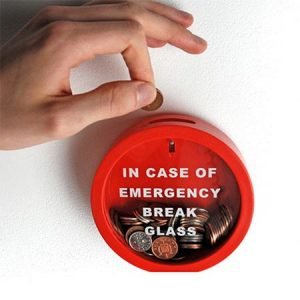

Set Aside An Emergency Fund

If you are a beginner in the field of savings you should initially set aside an emergency fund. Most people have no indication how much an emergency can damage their finances until it is too late. It is an acknowledged fact that nearly 66% of Americans which also include 46% of households with high incomes do not have adequate savings to pay for a $500 car repair or a hospital bill of $1000. Matters like unemployment and no savings to cover the basic needs can shock the wits out of you during an emergency.

If you are a beginner in the field of savings you should initially set aside an emergency fund. Most people have no indication how much an emergency can damage their finances until it is too late. It is an acknowledged fact that nearly 66% of Americans which also include 46% of households with high incomes do not have adequate savings to pay for a $500 car repair or a hospital bill of $1000. Matters like unemployment and no savings to cover the basic needs can shock the wits out of you during an emergency.

The best way to safeguard yourselves against financial shocks is to have a couple of emergency funds in the form of the following:

- A rainy day fund which you can use on certain occasions to take care of unexpected expenses such as a broken car or a medical bill.

- An emergency fund must be bigger and a long-term saving plan. The funds set aside should cover at least 3 to 6 months of living expenses just in case you are unable to work for any reason.

When starting with your savings plan you are advised to go through your budgets to locate expenses which can be eliminated. You can reduce some expenses and consider cutting the others and you could realize that you are possibly saving a few hundred dollars every month.

Setting Aside Emergency Funds In Inaccessible Accounts

Having an emergency fund will not be beneficial if the account is easily accessible. You can invest the money in a long-term investment account or a retirement account for the short term but you are likely to be charged higher fees for withdrawing the money at an earlier date. Therefore you are advised to have two separate savings accounts out of which one should be for the rainy day and the other should be for emergencies.

Automating Your Savings

Automating your savings is another option which you should be considering because if you do not you are likely to reach the end of the month before realizing you do not have the funds available to put into savings as you had planned. Merely relying on your willpower will not be sufficient particularly if you are just beginning to save.

When you automate your savings the money will be withdrawn from your paycheck before you receive it. It will prohibit you from spending anything while at the same time ensure that your savings and emergency account remain in healthy condition.

When you automate your savings the money will be withdrawn from your paycheck before you receive it. It will prohibit you from spending anything while at the same time ensure that your savings and emergency account remain in healthy condition.

Use Your Head And Not an App

You can find a number of apps on your cell phone and your desktop which all promote savings in various ways. Do not fall prey to one of these apps because they have no control over your income whereas you have absolute control over the app. Your savings plan will be down the drain unless you decide to use your head instead of the app.

Staying Away From High-Interest Debt

This will be a challenging task but it has the potential of saving you plenty of money. However, you must be trying to Stay away from credit card debt which can cost you a great deal especially if you are in the habit of holding back payments. However, you must also have some funds in your savings account because you wouldn’t want to use your credit cards if you ever had to deal with an emergency, would you?

More in Life Style

-

Brewing Controversy: Unraveling the Bud Light Boycott

In a world fueled by opinions, the recent Bud Light boycott has stirred quite the commotion. It’s not your typical tale...

December 7, 2023 -

How LVMH Became a $500 Billion Luxury Empire

LVMH Moët Hennessy Louis Vuitton is a name synonymous with luxury and opulence. The brand has crafted not just products but...

December 2, 2023 -

Women Spend 20% More Per Year on Out-of-Pocket Health Costs

A recent report from Deloitte has brought to light a concerning issue in the world of healthcare – women spend a...

November 24, 2023 -

How Sound Baths Can Soothe Your Mind, Body and Soul

Have you ever been so caught up in a song that you felt the world melt away? Music, in its many...

November 18, 2023 -

What to Know Before Rebalancing Your Investment Portfolio

Managing an investment portfolio is akin to steering a ship through ever-changing waters. Periodic adjustments are necessary to ensure you stay...

November 11, 2023 -

Jeff Bezos and Fiancée Lauren Sánchez’s Extravagant $500 Million Superyacht

Get ready to set sail on a journey into the opulent world of Amazon founder Jeff Bezos and his fiancée Lauren...

October 31, 2023 -

How to File Your Taxes: A Comprehensive Guide

Filing your taxes can be daunting, but with the right knowledge and preparation, it doesn’t have to be overwhelming. Taxes are...

October 26, 2023 -

Make Your Kids Mini Master Chefs | Here’s How

For many of us, the kitchen is the heart of our homes – a place where magic happens, one dish at...

October 19, 2023 -

Deciphering Stock Market Sell Signals

In the fast-paced world of stock trading, understanding when to sell your investments is just as crucial as knowing when to...

October 12, 2023

You must be logged in to post a comment Login