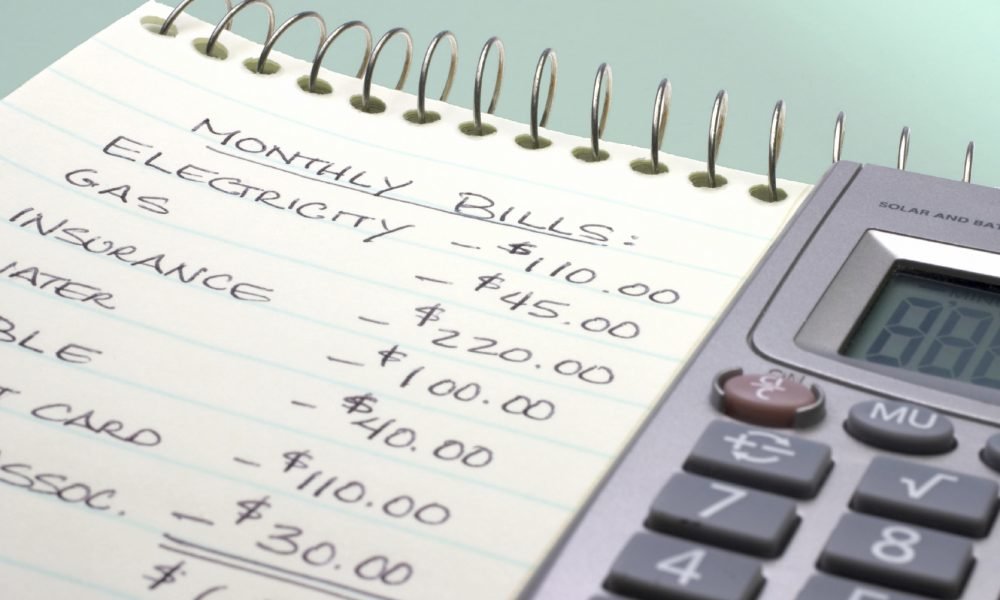

Effective Methods To Cut Living Expenses

The economy is showing signs of recovering and the job market is also displaying positive signs. However, a large number of people are still struggling to cope up with their monthly expenses. Approximately one-third of Americans who are earning in the region of $75,000 or more are currently looking at a financial disaster. The matter is even worse for people who are earning in the original $100,000 or more because they have been living from paycheck to paycheck for the last few months.

The reasons for the concerns faced by Americans vary but eventually most consumers will be required to cut their living expenses in order to survive. We provide for you a few tips which can help in reducing your living expenses.

[su_quote cite=”Benjamin Franklin” class=”cust-pagination”]”Beware of little expenses. A small leak will sink a great ship.”[/su_quote]

Downsize Your Situation To Meet Living Expenses

For most Americans, the largest living expense comes in the form of housing regardless of whether they are living in an apartment, recreational vehicle or cabin, or a family home they are required to incur a cost for the housing. As housing expenses on accounting for the major portion of your monthly income Americans will be required to evaluate how they can reduce these costs. People who are living in a single bedroom apartment can consider moving into a studio. Homeowners can also consider downsizing to a smaller property that is inexpensive.

For most Americans, the largest living expense comes in the form of housing regardless of whether they are living in an apartment, recreational vehicle or cabin, or a family home they are required to incur a cost for the housing. As housing expenses on accounting for the major portion of your monthly income Americans will be required to evaluate how they can reduce these costs. People who are living in a single bedroom apartment can consider moving into a studio. Homeowners can also consider downsizing to a smaller property that is inexpensive.

People who are living in a single bedroom apartment can consider moving into a studio. Homeowners can also consider downsizing to a smaller property that is inexpensive.

Living Expenses Can Be Cut By Having Meals At Home

We are currently living in a fast-paced world where families do not have the time to have meals together leave alone cooking for the entire family. Many people are finding it easier to pick up a take-out or have their meals at a restaurant. Americans are spending billions of dollars simply on eating out every year. This is another living expense which Americans should be trying to curtail.

We are currently living in a fast-paced world where families do not have the time to have meals together leave alone cooking for the entire family. Many people are finding it easier to pick up a take-out or have their meals at a restaurant. Americans are spending billions of dollars simply on eating out every year. This is another living expense which Americans should be trying to curtail.

The costs of reaching out are not affordable and the bills can add up quickly especially if a family is accustomed to eating out regularly. One of the best methods to free up some money would be to eat in more often. Americans can make a beginning by cutting down on their weekly outings because it will still give them an opportunity to save some money.

Banking Fees Can Also Add up As Living Expenses

Banks are supposed to help you save money and not to spend it. However, it has been observed that quite a few people waste money on fees that are associated with banking. Most banks are making billions of dollars every year from fees that are charged for every service that is offered. Despite banking fees being expensive a number of consumers are happily paying the fees.

People should be trying to avoid these expenses by making withdrawals from the bank’s ATM and having sufficient money in their account to cover for checks and shopping with low-cost banking fees. The competition within the banking industry is high and people who ensure they deal with the bank that doesn’t charge them a huge amount of their business will quickly find that their living expenses are coming down by a small margin.

Paying in Cash Can Also Supplement Living Expenses

The Economy is fueled by credit and it is easy to offer a credit card for any purchases and forget about it. However, in most cases, these are impulse purchases and are getting a number of Americans in trouble. The average household debt in America is around $15,706 but the quantity of credit card debt is double or triple the figure of household debt. Having credit card debt will mean that people will be charged credit card fees that will be expensive and also a drain on living expenses. Therefore Americans are required to decide to pay in cash because it can supplement living expenses.

Increasing your living expenses is easy but managing them can be a challenge. People who are struggling with living expenses have several options available to them that should be used because these are simple and easy methods which can prove beneficial for all Americans.

More in Life Style

-

Turn Your Rental Space Into Your Home With These Effective Tips

Get to Know Your Boundaries Before you start planning your mini-makeover, it is crucial to understand the limitations set by your...

December 14, 2023 -

Brewing Controversy: Unraveling the Bud Light Boycott

In a world fueled by opinions, the recent Bud Light boycott has stirred quite the commotion. It’s not your typical tale...

December 7, 2023 -

How LVMH Became a $500 Billion Luxury Empire

LVMH Moët Hennessy Louis Vuitton is a name synonymous with luxury and opulence. The brand has crafted not just products but...

December 2, 2023 -

Women Spend 20% More Per Year on Out-of-Pocket Health Costs

A recent report from Deloitte has brought to light a concerning issue in the world of healthcare – women spend a...

November 24, 2023 -

How Sound Baths Can Soothe Your Mind, Body and Soul

Have you ever been so caught up in a song that you felt the world melt away? Music, in its many...

November 18, 2023 -

What to Know Before Rebalancing Your Investment Portfolio

Managing an investment portfolio is akin to steering a ship through ever-changing waters. Periodic adjustments are necessary to ensure you stay...

November 11, 2023 -

Jeff Bezos and Fiancée Lauren Sánchez’s Extravagant $500 Million Superyacht

Get ready to set sail on a journey into the opulent world of Amazon founder Jeff Bezos and his fiancée Lauren...

October 31, 2023 -

How to File Your Taxes: A Comprehensive Guide

Filing your taxes can be daunting, but with the right knowledge and preparation, it doesn’t have to be overwhelming. Taxes are...

October 26, 2023 -

Make Your Kids Mini Master Chefs | Here’s How

For many of us, the kitchen is the heart of our homes – a place where magic happens, one dish at...

October 19, 2023

You must be logged in to post a comment Login