Why Joint Bank Accounts for Unmarried Couples Are a Problem

A joint bank account is a type of bank account that is shared between two or more individuals. It allows multiple account holders to deposit, withdraw, and manage funds collectively. Joint bank accounts are commonly used by couples, family members, business partners, or any group who need to pool their finances and have shared access to funds.

What Is a Joint Bank Account?

A joint bank account is a shared financial account held by two or more individuals. All account holders have equal rights and access to the funds within the account. Joint accounts can be opened at various financial institutions, including banks and credit unions, savings accounts, or checking accounts.

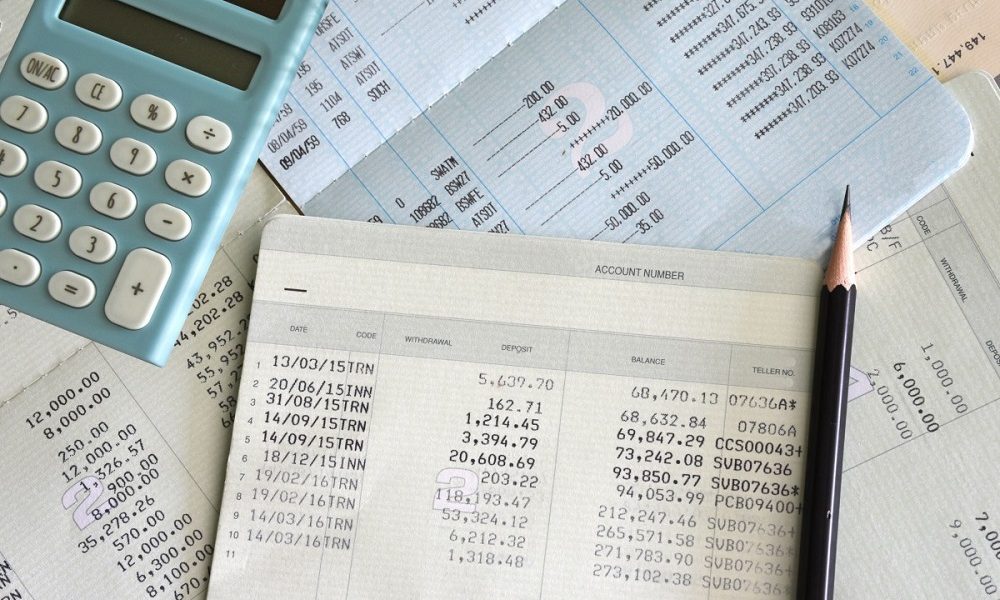

Kristine Gill/ GETTY IMAGES | Many unmarried couples have peacefully maintained joint bank accounts for years

How Does a Joint Bank Account Work?

To open a joint bank account, all account holders must provide their identification and complete the necessary paperwork as required by the bank. Once the account is opened, each holder will typically receive a debit card and/or checks linked to the joint account. Account holders can deposit or withdraw money from the account, make payments, transfer funds, and perform other standard banking transactions.

Benefits of Joint Bank Accounts

Emergency Access

In the case of an emergency, having a joint bank account ensures that both account holders have immediate access to funds. This can be particularly useful when one account holder is unavailable or incapacitated.

Westend61/ Getty Images | Joint bank accounts can be a simple way of managing shared payments such as bills.

Simplified Money Management

A joint bank account simplifies the process of managing finances. Instead of juggling multiple individual accounts, all account holders can contribute to a single account and have a clear overview of their combined financial situation. This can make budgeting, tracking expenses, and setting financial goals more straightforward and efficient.

Financial Planning and Saving Goals

Joint accounts can benefit couples and families with common financial goals. Whether saving for a down payment on a house, planning for a vacation, or building an emergency fund, a joint account allows for collective savings and tracking progress toward shared objectives. It encourages financial collaboration and supports a sense of unity in working towards common financial aspirations.

Considerations and Potential Challenges

Privacy and Individual Expenses

While joint accounts are helpful for shared expenses, they may not be suitable for managing personal or discretionary spending. Each account holder may still need to maintain separate individual accounts to safeguard their privacy and manage personal expenses.

Lindsay Cook/ FT | A partner’s debt could be an issue

Relationship Changes

Joint bank accounts can become complicated if there are changes in relationships. In the event of a breakup, divorce, or dissolution of a business partnership, it may be necessary to untangle financial ties and separate assets. Considering potential scenarios and understanding how the joint account will be managed in such situations is crucial.

Credit Implications

Joint accounts can affect the credit of all account holders. If one account holder has poor credit or defaults on payments, it can impact the credit scores of all individuals associated with the account. It’s important to be aware of this potential risk and ensure responsible financial management by all account holders.

More in Financial Adviser

-

`

What Credit Score Do You Start With? The Ultimate Guide to Understanding Credit Scores

Embarking on your financial journey is an exciting milestone, especially when it involves applying for your first credit card or taking...

May 30, 2024 -

`

The Best Fairy Garden Ideas to Create Your Own Enchanted Outdoor Space

Ah, fairy gardens! These whimsical little setups are hugely popular because they connect you with your sometimes long-lost imaginations and allow...

May 25, 2024 -

`

Here Are the Top 4 Stunning Private Jet Interior Designs

Have you ever wondered what it’s like inside the world’s most luxurious private jets? Long gone are the days when private...

May 19, 2024 -

`

How to Cash a Check Without a Bank Account: What You Need to Know

Have you ever found yourself holding a paper check but without a bank account to deposit it into? It might seem...

May 12, 2024 -

`

You Won’t Believe How Arnold Schwarzenegger Made His First Million – Clue: It’s Not Acting

With a net worth of $400 million, you’ll think that Arnold Schwarzenegger made his fortune from the entertainment industry, having starred...

May 1, 2024 -

`

Smart Investing Strategies & Insights

Investing is a brilliant way of generating wealth and securing your future financially. However, success in the stock market and other investment vehicles...

April 26, 2024 -

`

Is Buldak Carbonara Spicy Noodles Worth the Hype?

Buldak Carbonara Spicy Noodles are making waves in the culinary world, fusing the fiery kick of Buldak with the creamy richness...

April 25, 2024 -

`

These Pink Tesla Will Change Your View of the Pink Color Through and Through

In the world of electric vehicles, innovation does not just stop under the hood. It spills over onto the body, the...

April 16, 2024 -

`

How to Redeem U.S. Savings Bonds : A Step-By-Step Guide

Have you ever found yourself sitting on a treasure trove of U.S. savings bonds, wondering how to cash them in? Well,...

April 10, 2024

You must be logged in to post a comment Login