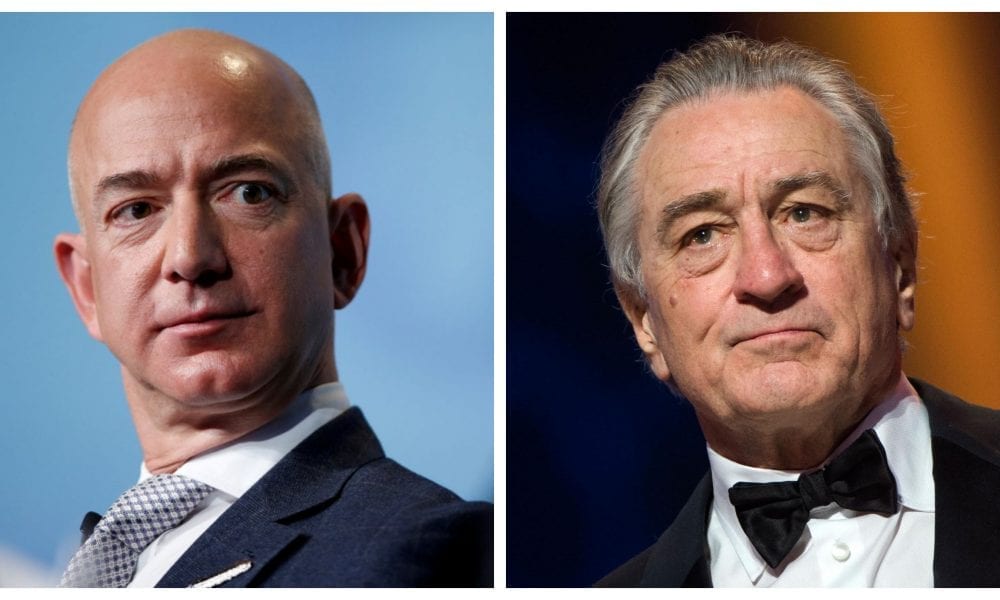

Jeff Bezos and Robert De Niro Lost Millions in Divorce, Here are Some Common Pitfalls You Can Avoid

Getting a divorce from a spouse is a rigorous and time-consuming process –not to mention the pain that comes with parting ways with the person you had once thought that you’d spend the rest of your life with.

By no means is it an easy decision, especially if you’ve tried every single way to save the marriage, from giving each other time and space to trying couples counseling to work out your differences. But when a relationship has run its course, there’s not much that can be done to save it.

Making the decision to end a broken relationship is undoubtedly one of the most painful experiences of life and it can have a weighty effect on both parties, both emotionally and financially.

Getting a divorce from your once-better half is a hard and rigorous process

However, you should always think of what lies ahead. You have the tendency to make harsh and irrational decisions at this point when you’re hurting, which may only result in unwanted heartaches and wasted time and this may also cost you a fortune in the future.

Take Jeff Bezos or Robert De Niro as an example, both of whom lost a fortune in divorce settlements. While De Niro had signed a prenup at the time of marriage, a smart move that protected his $300 million net worth, Bezos wasn’t so lucky. The world’s richest man lost half of his fortune to ex-wife MacKenzie after the divorce.

This is why it’s important to know and understand the common divorce pitfalls so you can avoid them. Despite finding it hard to set aside emotions, you should protect yourself financially. Here are some ways to avoid mistakes in this process:

Take a Rest from Social Media

For some, going through the divorce process may be so heartbreaking that posting about it on social media is usually forgotten – then there are some who become more active when the process is still ongoing.

While it is acceptable that at one point you share relatable quotes or sayings about heartaches and breaking up, it is best to filter the ones that get seen by the public.

Attorney Jacqueline Newman advised not to bash your ex on social media, even if you just want to get the sympathy of family and friends. More so, you should never brag about the lavish things you bought, even if this was retail-therapy.

Newman explained that this is because these things can complicate the divorce procedure more. Social media posts can also be evidence, so when you feel that it may incriminate you, better leave it offline or unposted.

Jeff Bezos paid his ex-wife $37 billion in divorce settlement

Settle Things Out of Court

A 2015 survey showed that there is an average of $15,500 cost in divorce, while those involving child custody and support matters reached an average of $19,200 – these numbers could still soar depending if they will go to trial.

That’s why Newman suggests that couples should try mediation first, which will not involve any lawyer and will only rely on a neutral third party to help make an agreement.

As such, it would cost lower than usual divorce proceedings but will only work if the former love birds are willing to ending everything smoothly – needless to say, both parties must be cooperative and open, especially when it comes to finances.

However, some couples don’t split amicably and this usually results in messy court trials. Newman recommends collaborative divorce, wherein each spouse gets their respective lawyers that are trained for negotiation of deals that will be fair to both of their clients. This is ideal for couples with problematic relationships but don’t want to shell out more money.

Never Abandon Joint Credit Accounts

Creditors don’t have a hand in your divorce and they’re not bounded by the agreement between you and your spouse because the contract existed even before the divorce process began.

Say your other half decided to take responsibility for the credit account, this doesn’t mean that you’re off the hook – you can still be accountable because both of you signed the account.

Here’s what you should do: divorcing couples should close the accounts first and then remove the authorized users from the credit cards. Then, transfer the loan or credit to the new account of the one who will shoulder the debt.

Make sure that joint credit accounts are legally closed to avoid being held liable in the future

Prepare the Paperwork

You may not know it now, but you’ll certainly need some papers in the future, perhaps when your ex-spouse is unwilling to give them to you.

Personal financial specialist David Stolz said as early as now, you should gather documents that include balances and account numbers of your accounts, home improvement receipts, anything to prove payment for major assets like house and cars, and Social Security files that show your other half’s earnings and benefits.

Stolz further explained that these are the things that will be necessary for tax planning and retirement in the future. For example, a person who was married for at least a decade can claim from the Social Security survivor or spousal benefits based on the ex’s earnings history.

More in Financial Adviser

-

Brewing Controversy: Unraveling the Bud Light Boycott

In a world fueled by opinions, the recent Bud Light boycott has stirred quite the commotion. It’s not your typical tale...

December 7, 2023 -

How LVMH Became a $500 Billion Luxury Empire

LVMH Moët Hennessy Louis Vuitton is a name synonymous with luxury and opulence. The brand has crafted not just products but...

December 2, 2023 -

Women Spend 20% More Per Year on Out-of-Pocket Health Costs

A recent report from Deloitte has brought to light a concerning issue in the world of healthcare – women spend a...

November 24, 2023 -

How Sound Baths Can Soothe Your Mind, Body and Soul

Have you ever been so caught up in a song that you felt the world melt away? Music, in its many...

November 18, 2023 -

What to Know Before Rebalancing Your Investment Portfolio

Managing an investment portfolio is akin to steering a ship through ever-changing waters. Periodic adjustments are necessary to ensure you stay...

November 11, 2023 -

Jeff Bezos and Fiancée Lauren Sánchez’s Extravagant $500 Million Superyacht

Get ready to set sail on a journey into the opulent world of Amazon founder Jeff Bezos and his fiancée Lauren...

October 31, 2023 -

How to File Your Taxes: A Comprehensive Guide

Filing your taxes can be daunting, but with the right knowledge and preparation, it doesn’t have to be overwhelming. Taxes are...

October 26, 2023 -

Make Your Kids Mini Master Chefs | Here’s How

For many of us, the kitchen is the heart of our homes – a place where magic happens, one dish at...

October 19, 2023 -

Deciphering Stock Market Sell Signals

In the fast-paced world of stock trading, understanding when to sell your investments is just as crucial as knowing when to...

October 12, 2023

You must be logged in to post a comment Login