Is Your Credit Score Too Low? Here’s How Long It Takes to Revamp It

How important is a credit score? The higher it is, the more favorable your chances for getting a good rate when borrowing from financial institutions. And in such economic times, who can dare say that loans don’t come in handy?

Unfortunately, financial setbacks may negatively impact our credit score, further complicating our lives. The good thing is that you can recover from said setbacks, but the recovery period differs from one individual to the next.

A Crucial Role

As we all know, our credit score has a crucial role to play in every day life. The interest charged on your credit cards, mortgages, car loans, name them – all are subject to your score. And by the way, a very poor score means no loans for you.

Truth be told, they may seem like a mere three digits, but they can either make or break your life. They say that money isn’t the most important thing in life, but really, what can you do without it?

These three digits can make or break your life

According to Rod Griffin, a director at Experian, an individual’s credit history is what stands between high costs or great terms. As such, you’d want to avoid a huge shift in the negative for yours.

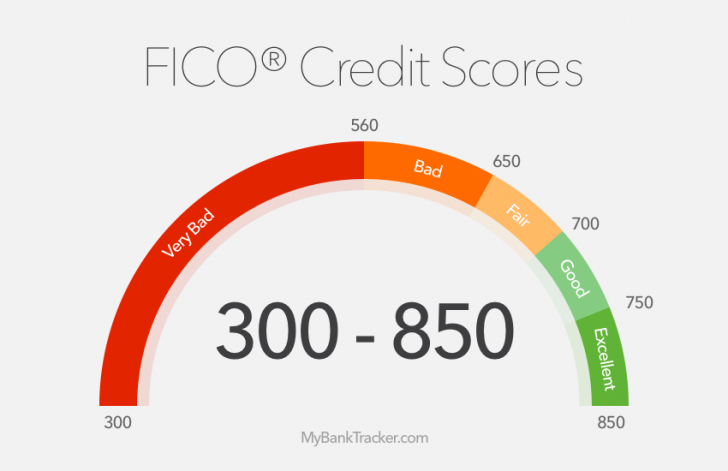

Fortunately, Americans are learning, and the credit score for an average citizen has been on the rise for the past decade. 10 years ago, there was a housing crisis due to defaulted mortgages, but that’s all in the past now. FICO reports that currently, credit scores are at a record high, averaging between 300 and 850.

But as is the case with any sensitive financial matter, defaulting or missing a payment on outstanding debts could be detrimental. The more you prolong having to pay up, the more your score shifts downwards, and you may find yourself moving from an excellent score to a poor one in no time.

If this is the case concerning missed payments, does it mean that the vice versa is true? You bet! To improve your score, make sure that everything is paid on time, and while doing so, ensure that your credit card balance is also reduced.

Pay everything on time

There’s even a working theory to help you navigate this – you know your available credit, don’t you? To avoid hurting your score, experts advise that your debt should always be less than 30% of this amount. Sounds workable, right? But you need to make smart decisions in order to keep the score consistent.

You’ll Get There

Well, if you’re already in a pickle having missed a series of payments, revamping your credit score may take a while, but you’ll get there if you are committed. If it’s just a single payment, you’ll have to persevere just for a month till you’re back on track, two if we are to give it an upper limit.

Of the various types of payments you can miss, mortgage tends to be the one with the most significant consequences. However, SuperMoney’s CEO Miron Lulic says that you can get from under this in less than a year, nine months to be specific.

Don’t even think about defaulting on your mortgage

However, if you choose the bankruptcy route, the CEO says that it may take you up to a decade to get back your perfect credit score. You now know what you have to do, don’t you? Go on then, and best of luck!

More in Financial Adviser

-

Brewing Controversy: Unraveling the Bud Light Boycott

In a world fueled by opinions, the recent Bud Light boycott has stirred quite the commotion. It’s not your typical tale...

December 7, 2023 -

How LVMH Became a $500 Billion Luxury Empire

LVMH Moët Hennessy Louis Vuitton is a name synonymous with luxury and opulence. The brand has crafted not just products but...

December 2, 2023 -

Women Spend 20% More Per Year on Out-of-Pocket Health Costs

A recent report from Deloitte has brought to light a concerning issue in the world of healthcare – women spend a...

November 24, 2023 -

How Sound Baths Can Soothe Your Mind, Body and Soul

Have you ever been so caught up in a song that you felt the world melt away? Music, in its many...

November 18, 2023 -

What to Know Before Rebalancing Your Investment Portfolio

Managing an investment portfolio is akin to steering a ship through ever-changing waters. Periodic adjustments are necessary to ensure you stay...

November 11, 2023 -

Jeff Bezos and Fiancée Lauren Sánchez’s Extravagant $500 Million Superyacht

Get ready to set sail on a journey into the opulent world of Amazon founder Jeff Bezos and his fiancée Lauren...

October 31, 2023 -

How to File Your Taxes: A Comprehensive Guide

Filing your taxes can be daunting, but with the right knowledge and preparation, it doesn’t have to be overwhelming. Taxes are...

October 26, 2023 -

Make Your Kids Mini Master Chefs | Here’s How

For many of us, the kitchen is the heart of our homes – a place where magic happens, one dish at...

October 19, 2023 -

Deciphering Stock Market Sell Signals

In the fast-paced world of stock trading, understanding when to sell your investments is just as crucial as knowing when to...

October 12, 2023

You must be logged in to post a comment Login