Lisa Frank Adorably Enters The Debit Card World

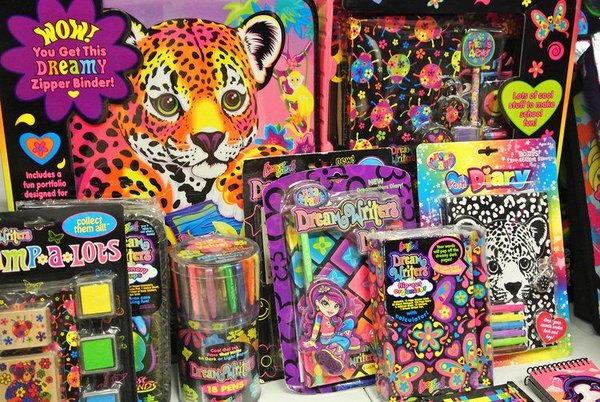

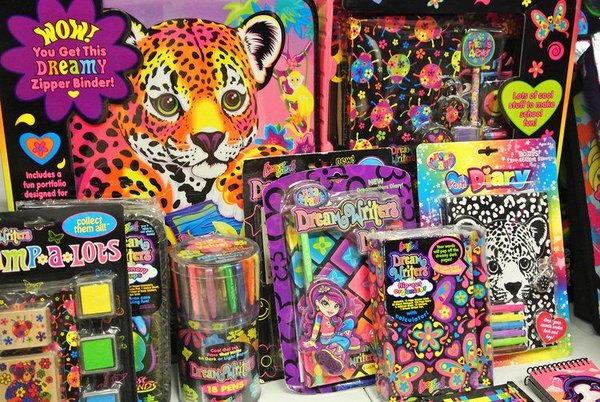

Girls who grew up in the 90s might remember those days when they personalized their pencil cases and binders with shades of purple and pink. Lisa Frank was everywhere back then, and you would be the cool kid in school if you had stickers or stationeries of cats and flying ponies to share.

Now, almost twenty years after the peak of its popularity, Lisa Frank is back and it has made a bold shift to modern day consumers, including Lisa Frank debit cards. Those who happen to be into Lisa Frank back then might consider adding this to their wallets. What is better is that a prepaid debit card is actually less burdensome and more manageable than a full-fledged debit card. Here are some things you should know about it:

What is a Prepaid Debit Card?

A prepaid debit card is an alternative banking card that lets you pay for transactions that you would with a debit card or a credit card, but it works much differently. When you have a prepaid debit card, you can enter into transactions with its payment network such as Visa or Mastercard. This is a much safer and convenient option than cash and at the same time, you can avoid all the big fees and responsibilities when you would have a credit card.

Unlike a debit card, you can only spend the amount of money that you deposit into your account, but this has become pretty easier to do. Some banks can allow you to do this through some clicks on your phone or computer.

You Are Not Required to Have Credit

Prepaid credit cards were designed for people who do not have a credit history, but would like to enter into some transactions which only a debit or credit card can allow them to. It is impossible to spend above your means with a prepaid card and it expires when the amount deposited is depleted. This makes it an excellent alternative for students and those who are recovering from heavy debt.

This, however, does not entitle its holder to build any credit at all. No matter how much you spend on prepaid credit cards, all your transactions will not be tracked by credit bureaus. This could perhaps be the best alternative for those who while they cannot have a credit card, would like to make purchases where cash is not accepted.

Is A Prepaid Debit Card for Me?

Around 9 million US households did not have bank accounts according to a survey conducted back in 2015. These people who do not have banks who want to get into transactions for a credit card, while they cannot for the moment or while they are not yet ready, might want to consider getting a prepaid credit card, to begin with.

These are even open for those who do not have bank accounts since they would not have to worry about overdrawing a checking account. Unlike credit cards, prepaid debit cards have big limitations.

They Come With a Lot of Features

Some prepaid debit cards let you pay all of your bills online. Some are advanced enough to even let you set up automatic monthly payments. Some can even allow you to withdraw the amount that you have loaded it with through ATM machines.

Some prepaid debit cards let you pay all of your bills online. Some are advanced enough to even let you set up automatic monthly payments. Some can even allow you to withdraw the amount that you have loaded it with through ATM machines.

Most prepaid credit cards can already be managed through an app on your phone and this gives you access to a lot of great features. What is even better is that there are so many convenient options for reloading. You can reload by just using your phone, deposit some money through an over the counter transaction or reload it at retail stores.

Some Drawbacks You Should Consider

There have been instances of several prepaid debit cards getting affected by technological outages that had lasted for weeks at a time. When RushCard switched its payment processor to MasterCard back in 2015, a glitch locked out thousands of users out of their accounts for days. Also, since these are not credit cards, you will not build credit with them no matter how much you take care of them.

There will also be some transactions which you will not have access to which you would otherwise have if you had a credit card such as access to an ATM branch network, wire transfers of stopping payments.

While a prepaid debit card might not be as comprehensive as a credit card, it is a great budgeting tool and an alternative to a bank. These tools can help you facilitate a lot of transactions as well as store and spend money more wisely and conveniently. What other benefits did you get from a prepaid debit card? Share them with us in the comments below

More in Life Style

-

Brewing Controversy: Unraveling the Bud Light Boycott

In a world fueled by opinions, the recent Bud Light boycott has stirred quite the commotion. It’s not your typical tale...

December 7, 2023 -

How LVMH Became a $500 Billion Luxury Empire

LVMH Moët Hennessy Louis Vuitton is a name synonymous with luxury and opulence. The brand has crafted not just products but...

December 2, 2023 -

Women Spend 20% More Per Year on Out-of-Pocket Health Costs

A recent report from Deloitte has brought to light a concerning issue in the world of healthcare – women spend a...

November 24, 2023 -

How Sound Baths Can Soothe Your Mind, Body and Soul

Have you ever been so caught up in a song that you felt the world melt away? Music, in its many...

November 18, 2023 -

What to Know Before Rebalancing Your Investment Portfolio

Managing an investment portfolio is akin to steering a ship through ever-changing waters. Periodic adjustments are necessary to ensure you stay...

November 11, 2023 -

Jeff Bezos and Fiancée Lauren Sánchez’s Extravagant $500 Million Superyacht

Get ready to set sail on a journey into the opulent world of Amazon founder Jeff Bezos and his fiancée Lauren...

October 31, 2023 -

How to File Your Taxes: A Comprehensive Guide

Filing your taxes can be daunting, but with the right knowledge and preparation, it doesn’t have to be overwhelming. Taxes are...

October 26, 2023 -

Make Your Kids Mini Master Chefs | Here’s How

For many of us, the kitchen is the heart of our homes – a place where magic happens, one dish at...

October 19, 2023 -

Deciphering Stock Market Sell Signals

In the fast-paced world of stock trading, understanding when to sell your investments is just as crucial as knowing when to...

October 12, 2023

You must be logged in to post a comment Login