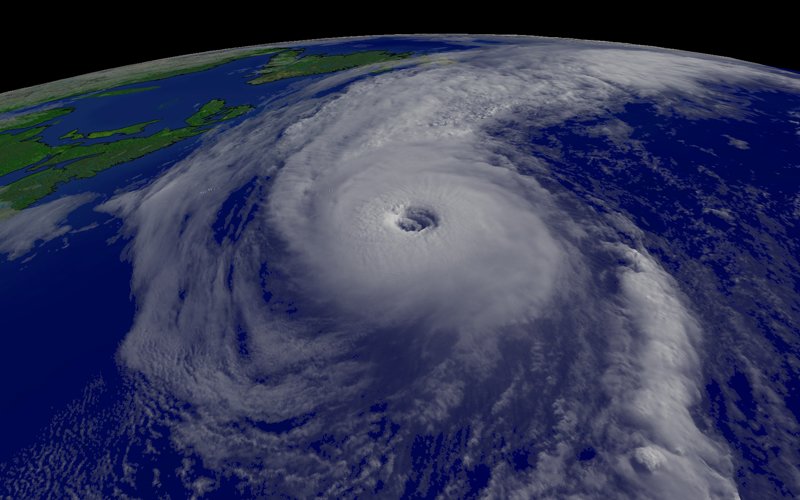

Hurricane Harvey: Wall Street Is Getting Ready for The Impact

Hurricane Harvey caused a lot of devastation during the course of this weekend, and over 30,000 people had to be rescued from their flooded homes. However, the storm that is named Harvey (it was downgraded from a hurricane to a tropical storm) has also affected the market by ravaging the oil and gas center of the country.

Wall street was having a breeze these last few months and was getting prepared to focus on job reports and tax reforms, before the news of Harvey’s effect on the nation. Now, they are definitely shifting the focus towards the ravaging of Texas and trying to figure out what their next step will be, as cnbc says.

In only 48 hours, the tropical storm has flooded Houston and some other parts of Texas with well over two and a half feet of rain falling.

Oil Production is Taking a Hit

While the entire event is definitely a tragedy, one of the biggest problems that concern the Wall Street was the fact that the devastation will definitely have a vastly negative impact on production. After all, most employees from the oil industry had to evacuate their positions and a lot of refineries had to close due to the flooding. This will lead to an inevitable increase in both gasoline and oil prices.

While the entire event is definitely a tragedy, one of the biggest problems that concern the Wall Street was the fact that the devastation will definitely have a vastly negative impact on production. After all, most employees from the oil industry had to evacuate their positions and a lot of refineries had to close due to the flooding. This will lead to an inevitable increase in both gasoline and oil prices.

While it is expected for the prices to normalize after the entire ordeal is done, nobody can, with absolute certainty, tell exactly when that will happen. We know that most refineries have avoided taking any serious damage to the important buildings, and the storm couldn’t destroy them. The floodwater is still a big issue and, until it subsides, it is anybody’s guess as to how serious the water damage is and when the employees can return to their working places. Almost half of the refining capacity of the United States is within the Gulf Coast and Houston is one of the largest centers in the States.

While the gas price increase will not make too much of a difference in the everyday life of an average citizen of the United States of America, the 5 – 15 cents per gallon increase will most definitely leave its mark in many portfolios.

Here is how

If you look at the tropical storms and hurricanes in the last few decades, you can see that some stocks tend to go up, while others drop in the wake of destruction. For example, you can expect energy stocks to rise, while utilities inevitably fall.

If you look at the tropical storms and hurricanes in the last few decades, you can see that some stocks tend to go up, while others drop in the wake of destruction. For example, you can expect energy stocks to rise, while utilities inevitably fall.

Whenever a storm similar to what Harvey has been downgraded to would happen (as the winds settled down Harvey has been degraded to categories 2 and 1, in that order), one could expect for insurance stock to go up by half of a percent in the following month. This is mostly due to the fact that claims were not as high as some would expect, while the demand for insurance would rise as people get scared.

However, as we have mentioned, stocks for energy are always the winners in this situation. In the 30 days following a catastrophe like Harvey, you can expect them to go up for at least 1 percent. Especially if the company is located near the affected area. And, while 1 percent does not seem like too much for a layperson, but an experienced stock trader can turn that 1 percent prediction into a lot of money. However, landfall can cause utilities to fall an average half of a percent in the following month.

What if it is a bigger storm?

But, if a storm belongs in the category 3 and causes severe flooding (more like what Harvey actually did), insurance stocks will go down instead of rising. In fact, during the month you can expect the fall of over 1 percent. This has been a general rule of thumb since the early eighties with every Category 3 hurricane (or worse). You can expect the similar happening to stocks of a utility company. Energy stocks would usually go up for about half of a percent while Standard and Poor’s 500 Index (commonly known as S&P 500) would go up by about a percent.

But, if a storm belongs in the category 3 and causes severe flooding (more like what Harvey actually did), insurance stocks will go down instead of rising. In fact, during the month you can expect the fall of over 1 percent. This has been a general rule of thumb since the early eighties with every Category 3 hurricane (or worse). You can expect the similar happening to stocks of a utility company. Energy stocks would usually go up for about half of a percent while Standard and Poor’s 500 Index (commonly known as S&P 500) would go up by about a percent.

Conclusion

Whenever something like this happens, traders might start reacting emotionally and buying stocks to get their hands on energy stocks right before it goes up. And, since Harvey specifically hit the refineries, that sentiment will be all the more serious.

Whenever something like this happens, traders might start reacting emotionally and buying stocks to get their hands on energy stocks right before it goes up. And, since Harvey specifically hit the refineries, that sentiment will be all the more serious.

More in Bank Stories

-

Brewing Controversy: Unraveling the Bud Light Boycott

In a world fueled by opinions, the recent Bud Light boycott has stirred quite the commotion. It’s not your typical tale...

December 7, 2023 -

How LVMH Became a $500 Billion Luxury Empire

LVMH Moët Hennessy Louis Vuitton is a name synonymous with luxury and opulence. The brand has crafted not just products but...

December 2, 2023 -

Women Spend 20% More Per Year on Out-of-Pocket Health Costs

A recent report from Deloitte has brought to light a concerning issue in the world of healthcare – women spend a...

November 24, 2023 -

How Sound Baths Can Soothe Your Mind, Body and Soul

Have you ever been so caught up in a song that you felt the world melt away? Music, in its many...

November 18, 2023 -

What to Know Before Rebalancing Your Investment Portfolio

Managing an investment portfolio is akin to steering a ship through ever-changing waters. Periodic adjustments are necessary to ensure you stay...

November 11, 2023 -

Jeff Bezos and Fiancée Lauren Sánchez’s Extravagant $500 Million Superyacht

Get ready to set sail on a journey into the opulent world of Amazon founder Jeff Bezos and his fiancée Lauren...

October 31, 2023 -

How to File Your Taxes: A Comprehensive Guide

Filing your taxes can be daunting, but with the right knowledge and preparation, it doesn’t have to be overwhelming. Taxes are...

October 26, 2023 -

Make Your Kids Mini Master Chefs | Here’s How

For many of us, the kitchen is the heart of our homes – a place where magic happens, one dish at...

October 19, 2023 -

Deciphering Stock Market Sell Signals

In the fast-paced world of stock trading, understanding when to sell your investments is just as crucial as knowing when to...

October 12, 2023

You must be logged in to post a comment Login