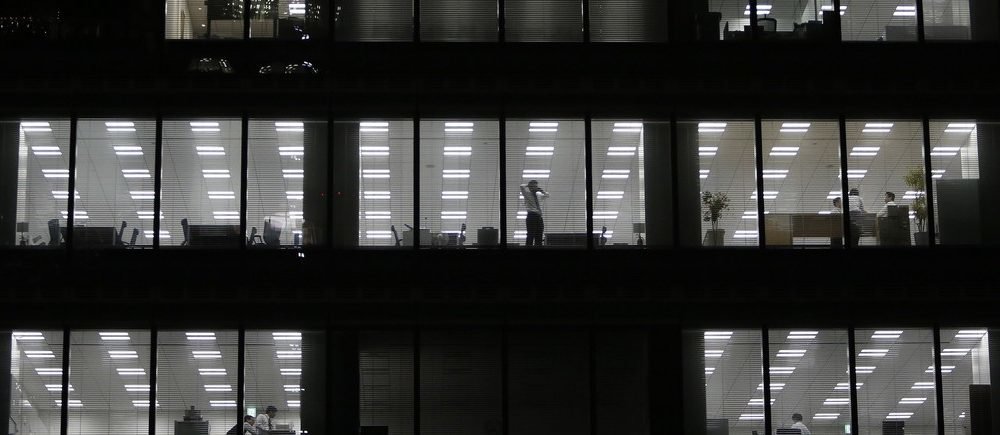

Bank Jobholders Are Facing an Increasingly Threatening Environment

At one point in time securing a job in a bank was considered to be a very good thing, not only because of the fixed number of hours but also because of the handsome salaries on offer. Those with a bank job were considered to have a stable career due to the low employee turnover in the banking sector. As banks had many branches around the country, people usually found a job in the branch closest to their home and hence significantly cut down on their daily commute between home and work.

However, now the tides are changing. Bank branches are shutting down at a very fast rate, with estimates suggesting that up to 60 branches on average are being shut down on a monthly basis around Britain. The reason behind such mass closures is the falling demand for physical branches, as an increasing number of customers are shifting to more convenient banking channels such as online banking or phone banking.

At one point in time securing a job in a bank was considered to be a very good thing, not only because of the fixed number of hours but also because of the handsome salaries on offer

Is Everyone On Board?

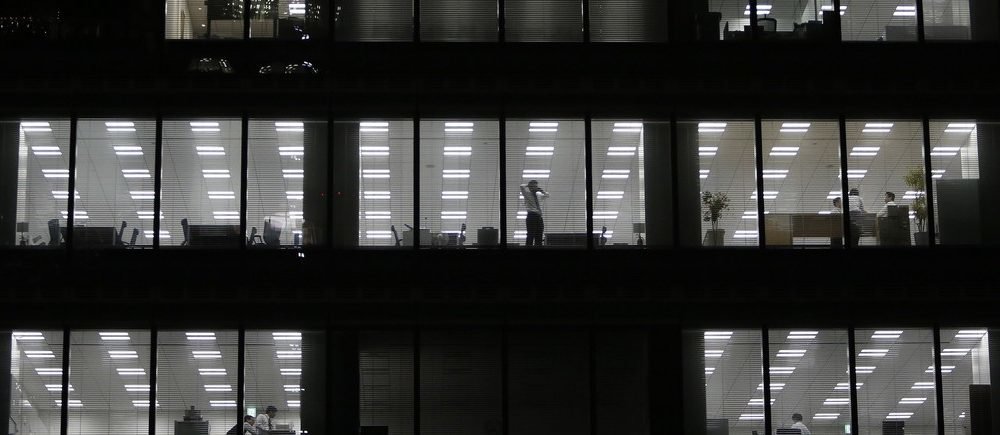

As banks continue to shut down their branches, a lot of stakeholders are being impacted by such actions. One such stakeholder is those customers who are not very tech savvy and hence want to engage with banking the old-fashioned way. They are also quite aged, and now that their nearby branch may close down, they’ll have to travel long distances just to access a branch by their bank, which can be a very exhausting activity in itself.

Banks understand this faction of their customer base, and to address their concerns they are doing whatever possible to make these new channels of banking more appealing to the traditional customers. Some banks such as the Bank of Scotland have gone so far that they have established mobile banking branches in order to reach those customers residing in the rural areas.

Another way banks can ensure that adequate support reaches their valuable customers is by engaging community bankers, those fully versed and trained members of the community who can offer banking assistance to anyone in need of it.

As banks continue to shut down their branches, a lot of stakeholders are being impacted by such actions

Community Bankers

This fairly new concept of community bankers is making a very big difference in the lives of those who otherwise have limited to no support as far as their banking needs are concerned. Community bankers organize events in public places such as libraries and clubs, and also visit private spaces such as the office or the private residence of an individual.

Many people seek help from these community bankers as they are the experts who also act as representatives of the bank. Services which community bankers are able to offer include a free assessment of the financial health of an individual, which is basically done to evaluate whether the individual’s finances qualify him or her for new products and/or services being offered by the bank. In addition to solving many of their banking woes, community bankers also educate people in the use of online banking methods so as to reduce their reliance on even community bankers..

Of course, community bankers are not ATM machines and for security and practical purposes don’t carry cash or details of the customers with them. Similarly, they can’t accept payments on behalf of the bank either.

The Case of NatWest

One of the banks closing off branches is NatWest, and hence it has deployed community bankers who are able to provide its customers with the information and guidance they need to take care of their banking needs through their online banking channels. Even if a customer wishes to apply for a savings account or for a mortgage, community bankers offer guidance on how all this can be done online, or by post, whichever method seems more suitable to the customer.

The bank also has an education program designed specifically for those who are not its customers right now, but may eventually become its customers in the future. The program, called MoneySense, is all about teaching those between the ages of 5 and 18 about good financial skills such as proper money management and how to avoid becoming trapped in a financial fraud or scam, among other learning points.

More in Bank Stories

-

Brewing Controversy: Unraveling the Bud Light Boycott

In a world fueled by opinions, the recent Bud Light boycott has stirred quite the commotion. It’s not your typical tale...

December 7, 2023 -

How LVMH Became a $500 Billion Luxury Empire

LVMH Moët Hennessy Louis Vuitton is a name synonymous with luxury and opulence. The brand has crafted not just products but...

December 2, 2023 -

Women Spend 20% More Per Year on Out-of-Pocket Health Costs

A recent report from Deloitte has brought to light a concerning issue in the world of healthcare – women spend a...

November 24, 2023 -

How Sound Baths Can Soothe Your Mind, Body and Soul

Have you ever been so caught up in a song that you felt the world melt away? Music, in its many...

November 18, 2023 -

What to Know Before Rebalancing Your Investment Portfolio

Managing an investment portfolio is akin to steering a ship through ever-changing waters. Periodic adjustments are necessary to ensure you stay...

November 11, 2023 -

Jeff Bezos and Fiancée Lauren Sánchez’s Extravagant $500 Million Superyacht

Get ready to set sail on a journey into the opulent world of Amazon founder Jeff Bezos and his fiancée Lauren...

October 31, 2023 -

How to File Your Taxes: A Comprehensive Guide

Filing your taxes can be daunting, but with the right knowledge and preparation, it doesn’t have to be overwhelming. Taxes are...

October 26, 2023 -

Make Your Kids Mini Master Chefs | Here’s How

For many of us, the kitchen is the heart of our homes – a place where magic happens, one dish at...

October 19, 2023 -

Deciphering Stock Market Sell Signals

In the fast-paced world of stock trading, understanding when to sell your investments is just as crucial as knowing when to...

October 12, 2023

You must be logged in to post a comment Login